- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

What West Africa means to us

With over 400 million in population and growth rates that have consistently carried the dynamic for the rest of the continent, the Western African region is seen as a hub for private sector development. Despite the COVID-19 pandemic, the region is expecting to grow at an above 4% rate in the coming years and the private sector is expected to play a central role in maintaining such growth levels.

When MCB Group established its strategy for growth, we ensured that it remained Africa-centric and reflected our appetite for African-specific risk. We did so by developing our network with corresponding financial institutions across the continent and by adapting our services to the realities of the markets. It is our belief that the West African private sector needs more support in mobilising financing to expand, to create more jobs and to play its role as a lever for development for this region. We see the region as an exciting market, due to its integration and the close proximity of its varying ecosystems with Europe and Northern America. We are also starkly aware of the urgency for financing, when considering the region’s development ambitions. MCB’s expertise and capacity to deliver swift results is what we believe will allow us to become a major partner for these ambitions.

To us, West Africa means impact: as Africa's second-fastest growing region in terms of population growth, West Africa presents tremendous possibilities to take part in projects that will directly touch people's lives for the better.

We aim to act as an investment channel between international actors and Africa, in order to foster structural projects in the region and the growth of Africa's trade relations with the world. MCB combines the rigor and transparency of an international bank with the adaptability and flexibility of a more agile structure. MCB also takes a human approach and considers it its own responsibility to maintain a permanent relationship with each client by offering tailor-made solutions.

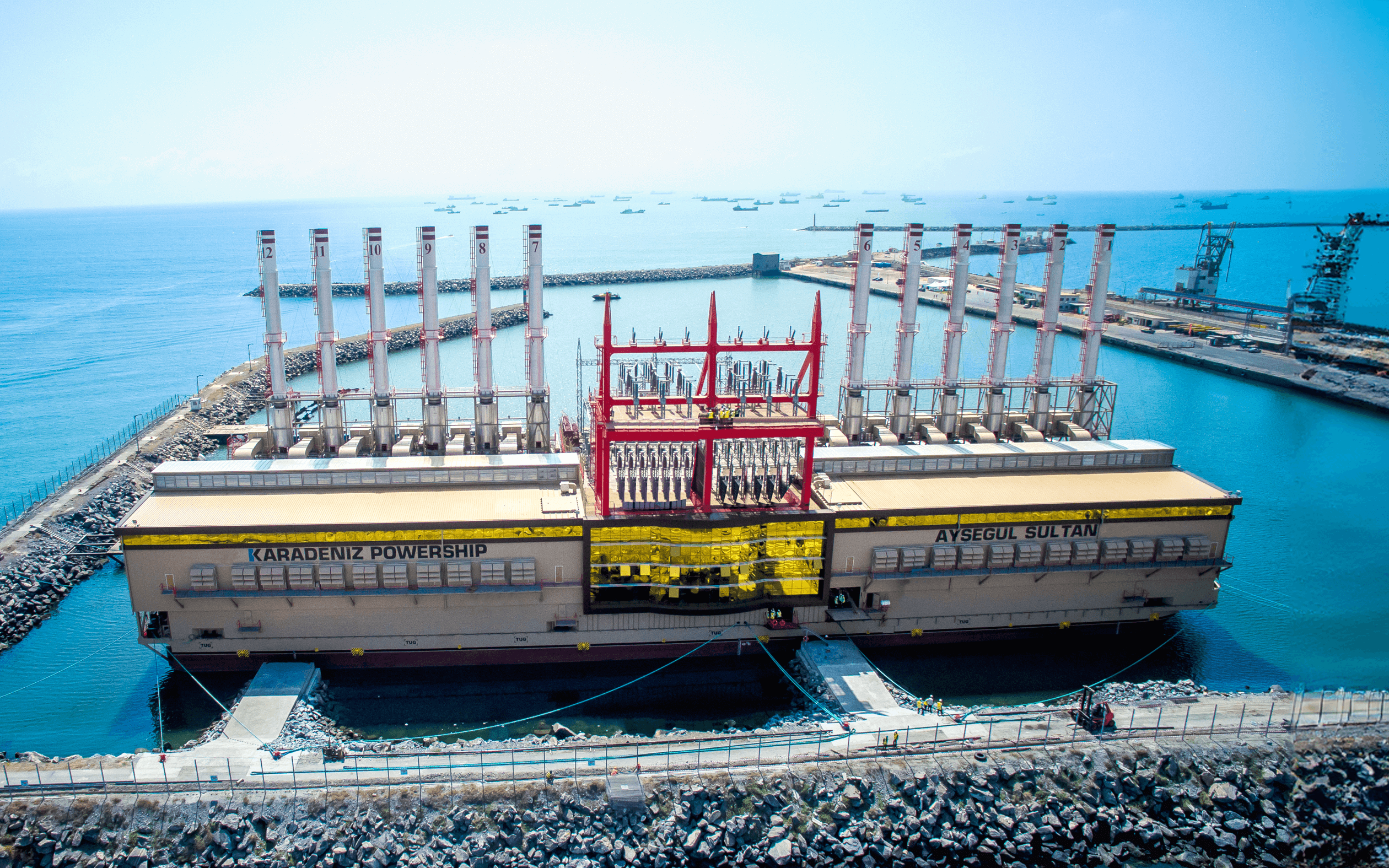

Our recent activities in the energy sector in Senegal speak to the potential of such partnership. In 2021, we enabled a USD 60 million loan to power a 235 MW powership that provides 15% of the country’s electricity supply. Two major transactions, the first alongside the Teyliom conglomerate and the second, the acquisition of SAPLED in Côte d'Ivoire, are also strong examples sent to the market of MCB's commitment to African entrepreneurs.

As we joined the rest of our private sector peers at this year’s Africa CEO Forum, the first since the pandemic has hit, we have been building new relationships to continue making an impact in the continent’s most dynamic region. Whereas the pandemic has seen some of the traditional heavyweight leave the region, we are, on the contrary, excited about the opportunities that will arise through the recovery process.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.