- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

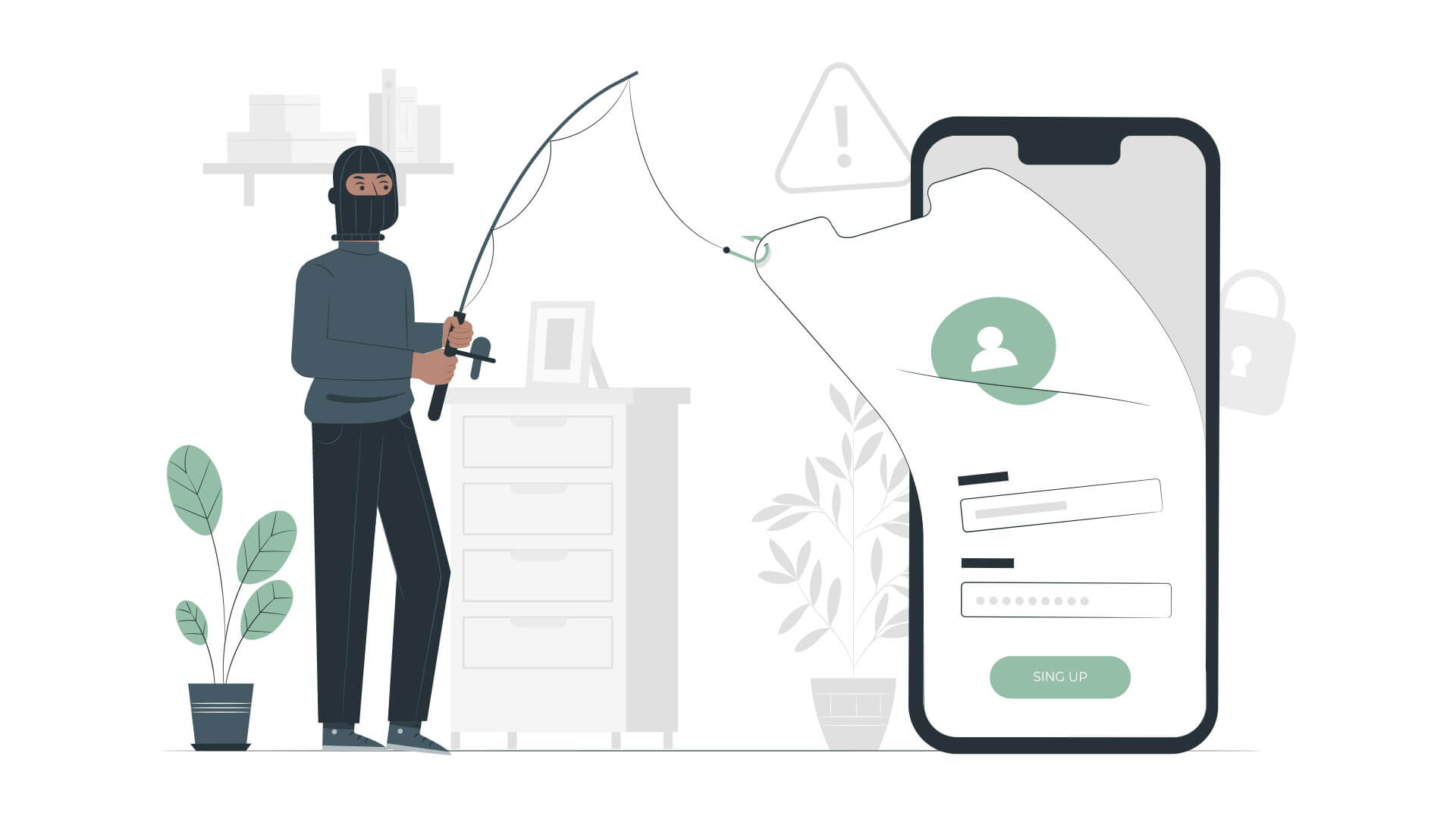

Identity theft prevention: 3 steps to keep your finances safe

Identity theft happens when someone steals your personal information—such as your name, ID number, or banking details—to commit fraud. This could mean opening credit accounts, applying for loans, or making unauthorised purchases in your name.

Falling victim to identity theft can damage your credit score, cause financial losses, and take months to fix. But with the right precautions, you can prevent identity theft before it happens.

1. Protect your personal information

Your ID, passport, banking details, and PINs should always be kept private and secure.

✅ Never share sensitive information over phone calls, emails, or texts.

✅ Store physical documents (ID, bank statements) in a secure place.

✅ Shred old documents instead of throwing them away.

💡 Pro Tip: If a company or bank asks for personal details, verify the request through an official channel before providing any information.

2. Secure your devices and online accounts

Hackers use malware, phishing emails, and weak passwords to access personal information stored on your phone or computer.

✅ Use strong passwords and enable multi-factor authentication on all accounts.

✅ Keep your operating system and apps updated to fix security loopholes.

✅ Install antivirus software to detect and block potential threats.

3. Check your bank statements regularly

Unexpected charges on your account could indicate that someone is using your identity for fraudulent transactions.

✅ Monitor bank statements for unknown withdrawals or purchases.

✅ Set up real-time alerts to track your transactions.

✅ Report any suspicious activity to your bank immediately.

📌 Takeaway: Identity protection is in your hands

By taking proactive steps, you can reduce the risk of identity theft and keep your finances secure.

📌 Need extra security? MCB provides fraud protection, secure online banking, and customer support to help safeguard your financial identity.Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.