- Home

- Investor Centre

- Sustainability

- Talent

- News

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

Contact Info

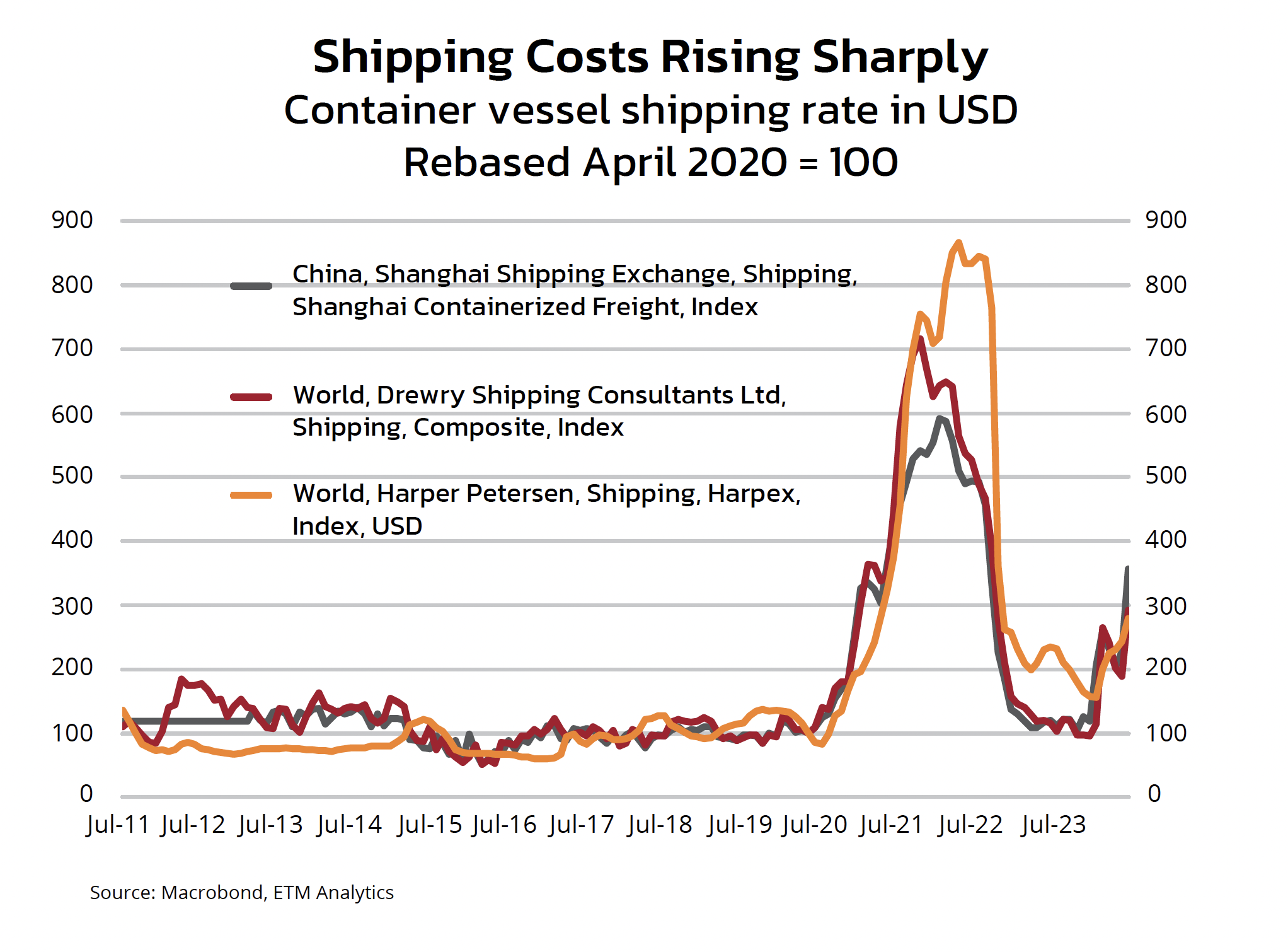

Freight prices rising sharply

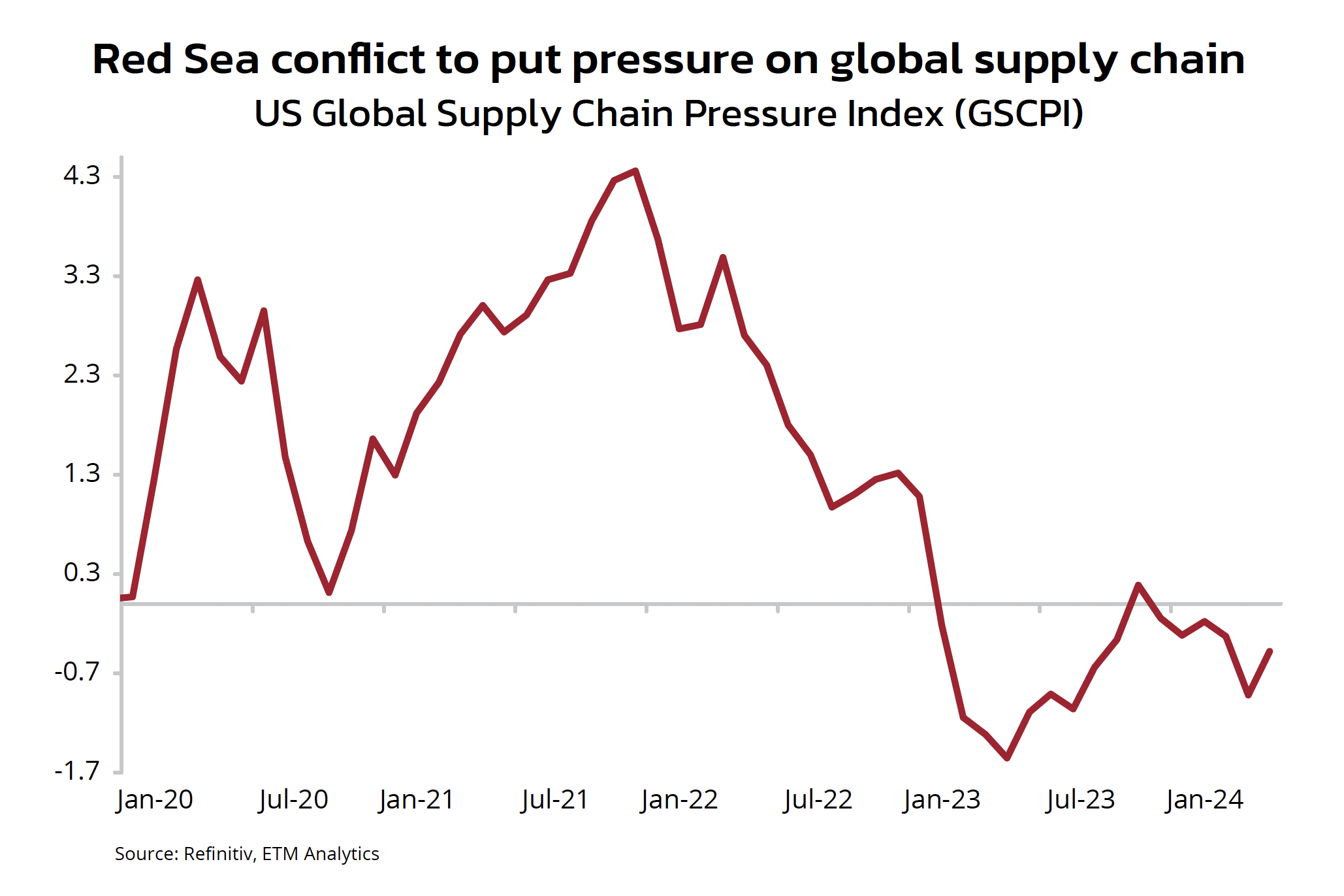

World shipping costs are rising sharply to levels last seen following the COVID-19 pandemic. While a sharp rise in consumer demand mainly drove the CV19 price surge, the latest price rise is supply-driven.

Nonetheless, the risk of rising freight costs is that inflation across the globe may remain sticky. This, in turn, may mean that interest rate cuts may be pushed out in advanced economies, which has been a common theme in recent months. Furthermore, although the likes of the Bank of Canada and the European Central Bank have led the pack in advanced economies by cutting rates, the extent of the interest rate cutting cycle may not be as great as previously expected depending on the degree to which rising shipping costs feed through into inflation globally.

Demand for freight is inelastic

In the freight market, demand does not change much when the price of the goods/services changes. In other words, in a competitive market with inelastic demand, when the demand for shipping goods surpasses the available cargo-carrying capacity, prices will increase significantly, and businesses will have to foot the bill. The latter depicts the current situation.

Factors contributing to rising shipping costs

Closure of the Suez Canal

It is no coincidence that shipping costs started to rise towards the end of last year as Houthi attacks on ships in the Red Sea led to disruptions and the eventual closure of the critical Suez Canal shipping route. As a result of the attacks, insurance costs have increased as well, raising total costs further.

Weather Conditions

Since the closure of the Suez Canal, the freight industry has been hit by a perfect storm, with weather playing a role. For instance, heavy fog and rain in China, Malaysia, and Singapore, respectively, increased port congestion, leading to delays.

Trade in North America has not been spared since the Suez Canal is the fastest route to the East Coast from South Asia and the Middle East. Ships must now go around the Cape of Good Hope, cross the Pacific, or go through the Panama Canal. However, a severe drought has led to authorities imposing restrictions on the Panama Canal, which relies on an artificial lake to function.

Potential Labor Strikes

The risk of strike action on the East and Gulf coasts in the US is rising. The union operating these ports, the International Longshoreman Association (ILA), has a contract expiring on 30 September. Historically, unlike their West Coast counterparts, these ports have avoided strike action. The last strike at these ports took place in 1977. The union alleges that automation is being used to displace workers.

Demand ramping up

Shipping prices could rise further as demand ramps due to concerns about delays and capacity constraints before the peak holiday shopping season of Black Friday and Christmas. Industry experts indicate that almost all fixed-rate contracts are subject to a “peak season surcharge” (PSS) implemented at the carrier’s discretion. Companies are forced to accept the rising costs because their cargo won't be loaded and shipped if they don't.

The effect on African countries

For Africa in particular, rising shipping costs and possible supply chain disruptions are likely to raise inflation, which is already surging to double-digit levels in many countries.

However, all is not lost. High shipping costs during the CV19 pandemic encouraged shipping companies to invest more in container ships. Ocean shipping capacity is projected to rise significantly over the next few years, addressing the capacity shortfalls caused by the rerouting of ships.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partner, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.