- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Financial Markets Analysis: How Europe Is Spending Big, and Keeping Markets Calm

How Europe Is Spending Big—and Keeping Markets Calm Europe is embarking on a major fiscal expansion, committing hundreds of billions of euros to defence, infrastructure, and collective security. What stands out is not just the scale of this spending—but how well markets have absorbed it. Despite the surge in planned borrowing, bond yields have remained relatively stable, suggesting investor confidence in the EU’s ability to manage its finances. But this resilience comes with caveats. The debt load is rising, and as geopolitical pressures mount and social obligations persist, Europe will need to strike a careful balance between funding its strategic ambitions and maintaining long-term fiscal sustainability.

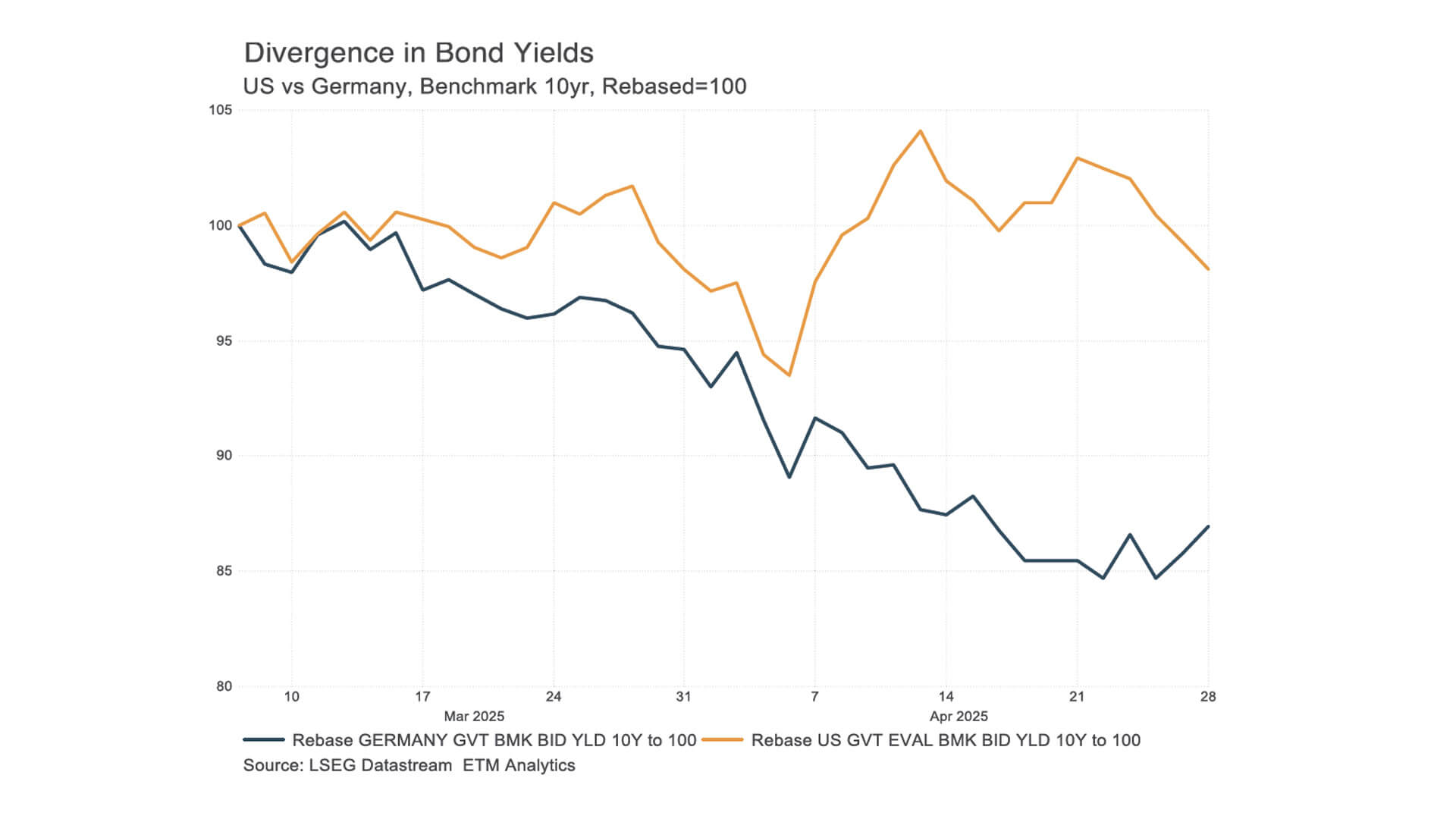

Big Plans, Steady Hands Germany—traditionally a symbol of fiscal conservatism—is now leading a €500 billion investment drive to upgrade defence and infrastructure. At the EU level, an additional €800 billion ($912 billion) has been committed, with €150 billion ($171 billion) financed collectively under the new SAFE programme. Despite this wave of spending, markets remain composed. German bond yields briefly rose to 2.9% in March before retreating to 2.5% by late April. Even Italian spreads stabilised near 100 basis points over Bunds, indicating that investors still view Europe’s fiscal path as credible—for now.

Why Aren’t Interest Rates Soaring? Three major factors are helping keep a lid on borrowing costs:

Capital Repatriation: European investors held $13.7 trillion in U.S. assets at the end of 2024, including $8.3 trillion in portfolio investments (ECB data). Amid growing concerns over the U.S. fiscal outlook, some of this capital is returning to Europe. Even a modest 10% shift would inject $1.3 trillion into European bond markets—enough to cover much of the EU’s new borrowing requirements.

A Stronger Euro: The euro has appreciated from $1.08 last year to $1.15 in April 2025, reducing imported inflation and giving the European Central Bank room to cut interest rates—further lowering government borrowing costs.

Germany’s Safe-Haven Status: German Bunds are increasingly viewed as a stable alternative to U.S. Treasuries, underpinned by the country’s AAA rating, which S&P Global reaffirmed as ‘credit positive’ in March.

Geopolitical Pressures Reshaping Europe’s Approach Europe’s fiscal shift is a response to shifting geopolitical realities. The changing posture of the United States, particularly under Donald Trump, has forced Europe to rethink its reliance on American security guarantees. This recalibration is pushing the EU to act more autonomously and invest in its own capabilities. However, this strategic turn brings with it new fiscal pressures. Policymakers will have to make difficult trade-offs between defence spending, economic investment, and the long-standing European commitment to social welfare. Italy, already burdened with high debt levels, remains especially vulnerable if investor sentiment shifts or capital inflows weaken.

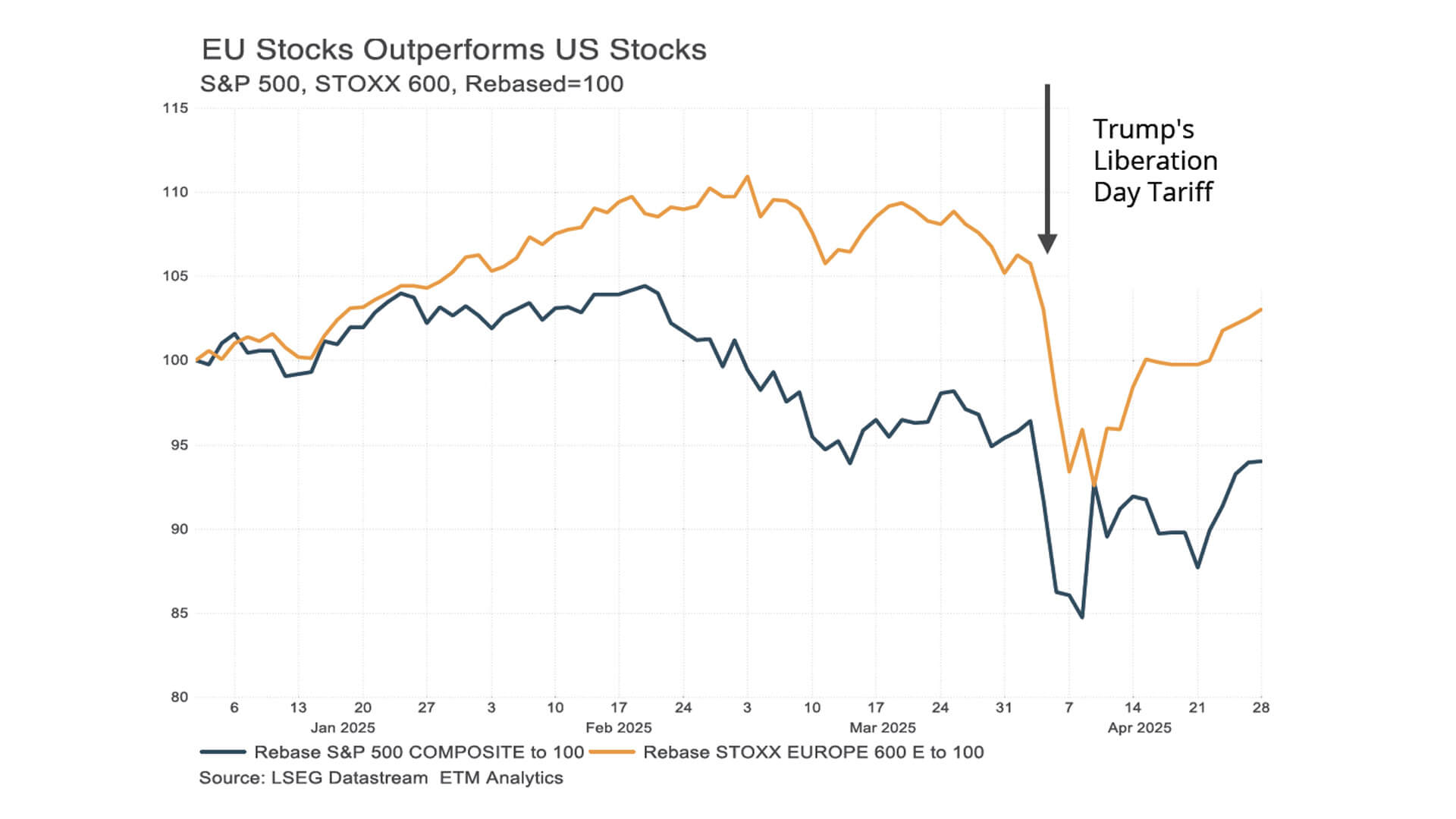

Market Resilience—and Underlying Risks The Eurozone’s government bond market, valued at around €10 trillion in 2023, is well-equipped to absorb inflows. Eleven Eurozone countries dominate this deep, efficient market, with low trading costs and strong credit ratings attracting institutional investors. But structural risks persist: European equities continue to underperform; political divisions within the EU could delay or weaken collective initiatives; and capital returning from the U.S. may do so more slowly—or not at all.

The Bigger Picture Europe is demonstrating that large-scale public investment can coexist with financial market stability—at least in the near term. But sustaining this balance will require careful fiscal management, especially as debt levels rise and economic fragmentation within the EU remains a live risk. The test will be whether Europe can turn this moment of relative calm into a durable framework for resilience, without sacrificing long-term sustainability or social cohesion.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.