- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Africa on the rise, but financing gaps remain

As Africa heads into 2026, the investment landscape is shaped by moderating global monetary conditions, widening regional divergence, and rising political and geopolitical uncertainty. The aggressive easing cycle of 2024–25 is fading, with major central banks signalling restraint and any further cuts increasingly data dependent. Sticky core inflation, persistent services price pressures, and geopolitical risks argue against rapid easing, pushing global capital towards selectivity and perceived safety rather than broad risk exposure.

For African markets, this environment is only marginally supportive. Financial conditions may be less restrictive than in recent years but fall short of a benign setting. Capital inflows should persist, though in a highly differentiated manner, rewarding policy credibility, fiscal discipline, and external resilience, while countries with weaker fundamentals remain vulnerable to shifts in global risk appetite. Political risk adds another layer of uncertainty, as twelve African countries hold national elections amid youth unrest and declining institutional trust; contested outcomes may trigger volatility, while credible polls could signal stability.

Within the continent, monetary policy paths will continue to diverge. Several central banks began easing in 2025 as food and fuel inflation moderated and supply chains normalised. This trend should extend into 2026, but cautiously. Policymakers in Nigeria, Egypt, Zambia and Kenya are likely to prioritise currency stability and positive real interest rates, limiting the pace of cuts. Inflation risks remain elevated where fiscal pressures, weather-related shocks or energy supply disruptions persist.

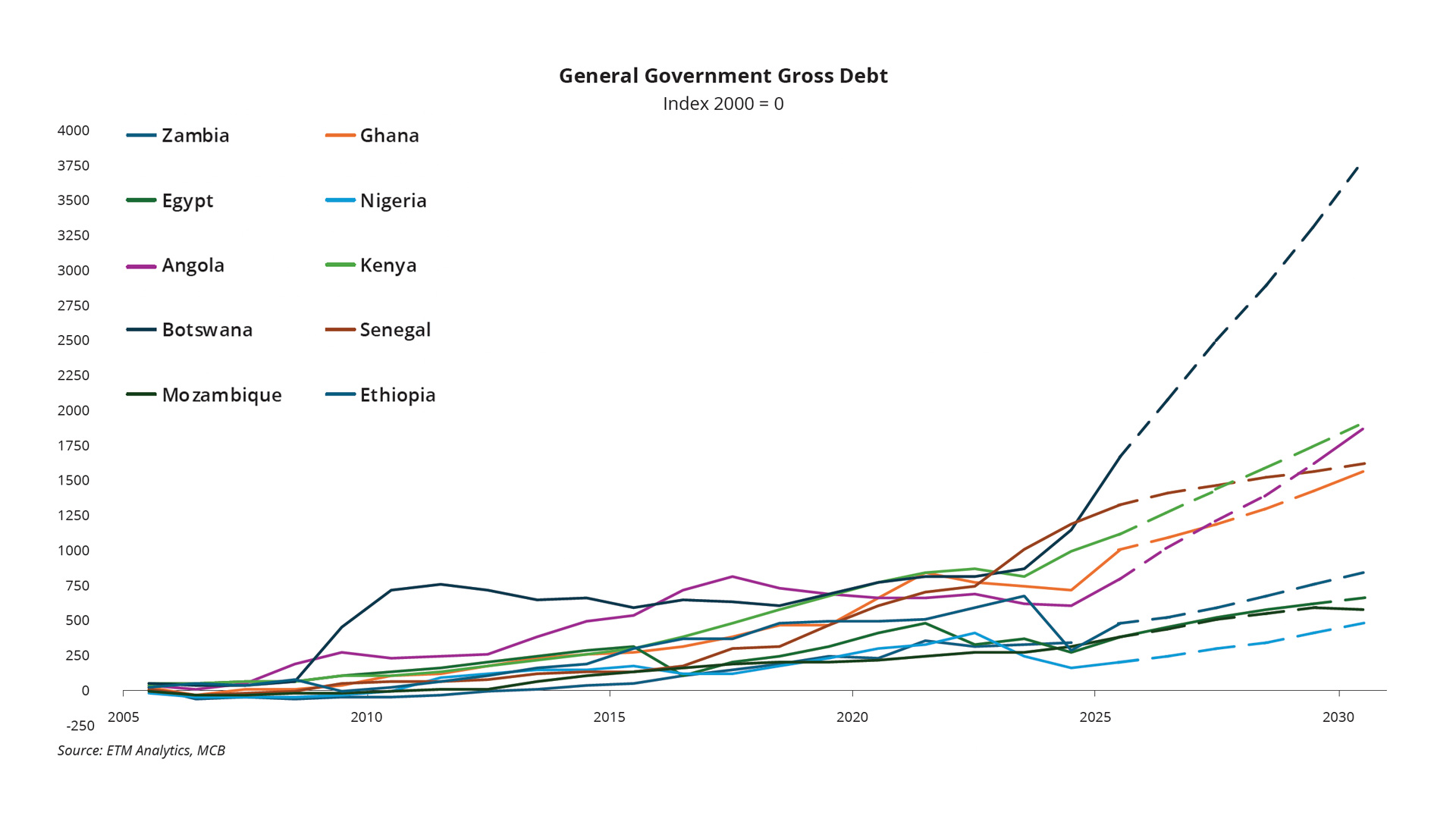

Debt sustainability remains a central vulnerability. Despite some relief from relatively lower global rates, debt servicing costs are expected to stay high, reflecting elevated borrowing and limited fiscal space. African countries face substantial financing needs this year, with Sub-Saharan nations confronting a near-$83 billion shortfall, driven largely by bond redemptions and refinancing pressures, as per BMI. For instance, Senegal faces high gross financing needs (budgeted at around 26% of GDP for 2026), including elevated debt repayments. Ghana, Zambia, and Ethiopia remain key restructuring cases, while Mozambique and Senegal face rising pressure linked to project delays, fiscal strain, and uncertain IMF engagement. Multilateral financing will remain critical in easing refinancing risks and supporting reform.

Despite these challenges, pockets of opportunity remain. AI adoption is emerging as a modest growth tailwind in countries with stronger digital infrastructure, while supportive prices for copper and gold benefit key exporters. Africa’s outlook in 2026 is neither uniformly bleak nor decisively positive, demanding disciplined investment, careful policy choices and robust risk management.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Strategy, Research and Development team and our Financial Markets research partner, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.