- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

MCB Group posts profits of Rs 14,1 billion

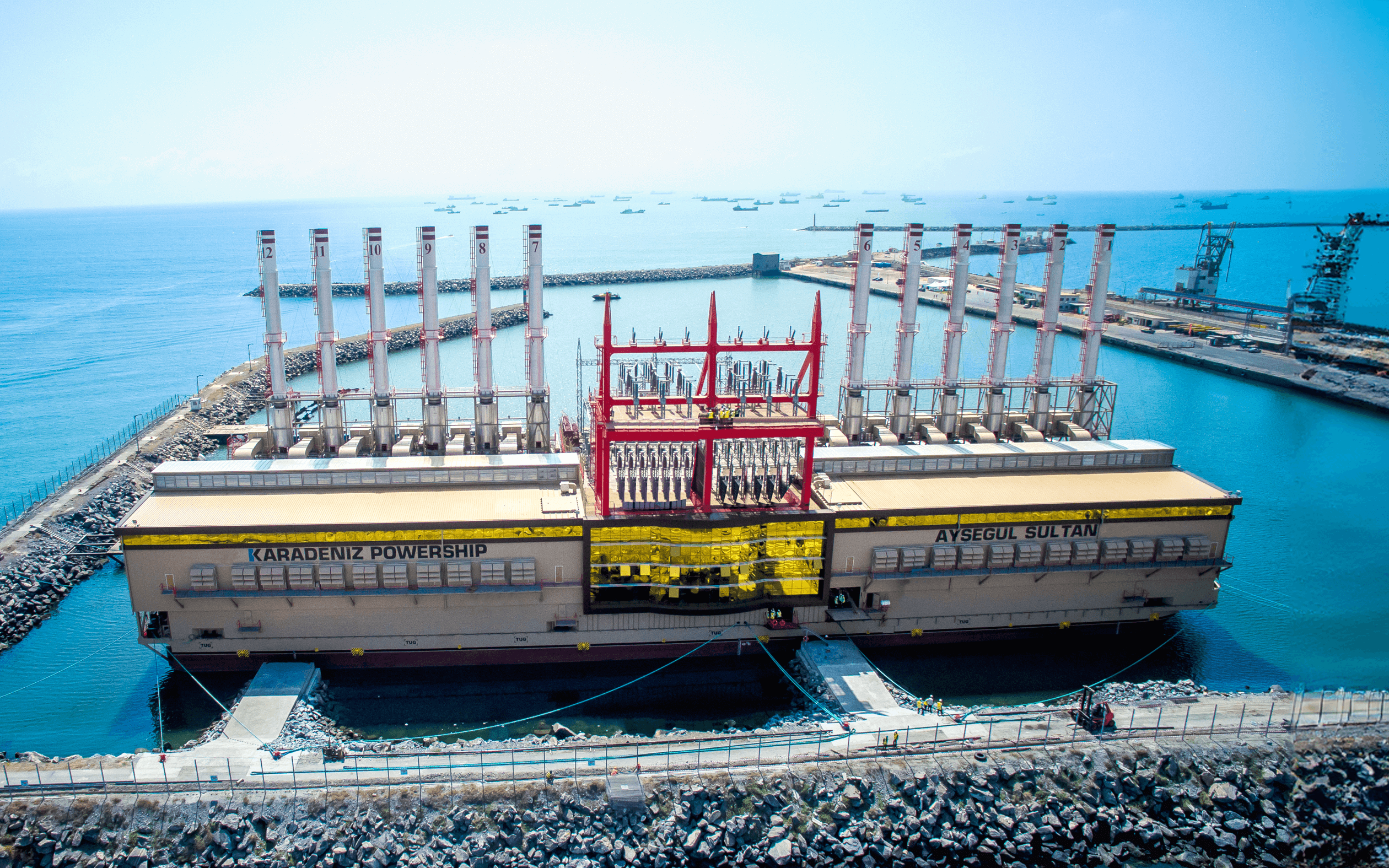

In spite of the constantly shifting and volatile landscape, the Group’s profits attributable to ordinary shareholders have demonstrated remarkable resilience and growth, increasing by 46.7% to Rs 14,133 million, largely underpinned by our international activities which contributed 62% of Group profits.

Operating income continued its upward trajectory, growing by 33.3%. Net interest income rose by 30.3%, driven by the increase in interest rates and the resulting improved margins on our interest-earning assets in foreign currency, as well as an expansion in both our foreign loan book and investment securities portfolio. Non-interest income displayed a robust growth of 38.7% to reach Rs 12,002 million on the back of a 12.9% increase in net fee and commission income notably from trade financing and payment activities as well as a solid growth of 92.4% in other income, mainly related to profits arising from foreign currency dealings and fair value gains from equity financial instruments.

Our ongoing investments in human capital and technological capabilities have resulted in operating expenses increasing by 23.3%, with, our cost to income ratio, nevertheless, declining to 35.4% compared to 38.3% for FY 2021/22. Our share of profit from associates increased by 8.5% driven by improved contribution from BFCOI.

Preserving our financial soundness has been paramount in these challenging times. Asset quality metrics have improved, with the gross NPL ratio standing at 3.2%. The Group consistently maintained prudent funding and liquidity position and remained well-capitalised with overall CAR and Tier 1 ratios of 19.2% and 16.7%, respectively.

Looking ahead, the global economic environment is still highly uncertain and volatile, with inflation, albeit on a slight downtrend, remaining persistent and geopolitical tensions mounting. Against this backdrop, the economic outlook for countries where we operate will remain subject to various headwinds, although the ongoing recovery driven by the momentum in tourism is encouraging. As we continue to monitor the implications of the challenging context on our business activities, we will remain focused on implementing our strategic initiatives and gearing up our internal capabilities. As a consequence, we are cautiously confident about FY 2023/24.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.